The Ultimate Beginner’s Guide to Forex Trading

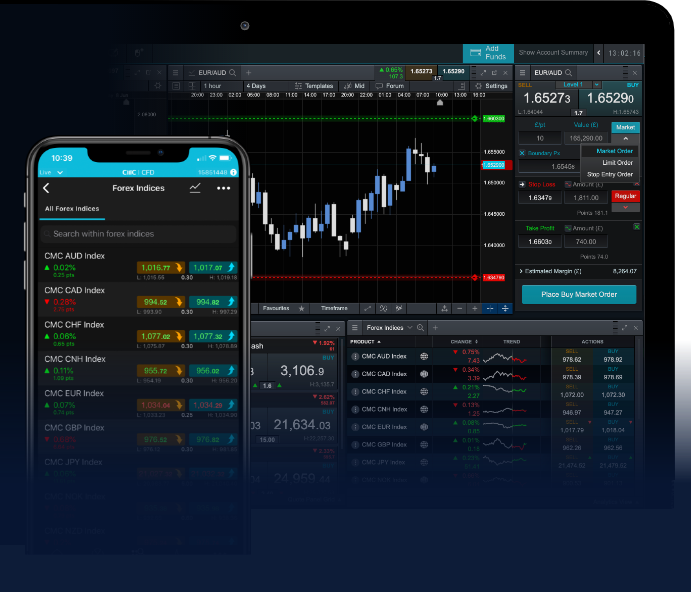

Forex trading, short for foreign exchange trading, is the process of buying and selling currency pairs in a decentralized market. Whether you’re looking to expand your investment portfolio or simply want to learn a new skill, this guide will provide you with the essential knowledge to get started in Forex trading. If you’re interested in trading on the go, consider downloading a reliable forex trading beginner guide Trading App APK to enhance your trading experience.

Understanding Forex Basics

Forex trading operates on a vast, global scale and is considered one of the largest financial markets in the world. The Forex market functions 24 hours a day, five days a week, providing traders with ample opportunities to engage in buying and selling currencies.

What is Currency Trading?

In currency trading, you always trade in pairs—for instance, EUR/USD or GBP/JPY. When you trade a currency pair, you are essentially betting on the value of one currency against another. If you believe that the euro will strengthen against the dollar, you will buy the EUR/USD pair.

Major Currency Pairs

There are three categories of currency pairs: major, minor, and exotic pairs. Major pairs include the most traded currencies, such as:

– EUR/USD

– USD/JPY

– GBP/USD

– AUD/USD

These pairs have the highest trading volumes and liquidity, often providing the most stable trading conditions for beginners.

Getting Started with Forex Trading

If you’re keen to start Forex trading, here are some fundamental steps to follow:

1. Educate Yourself

Knowledge is power in Forex trading. Explore educational resources—online courses, webinars, books, and tutorials—that can help you grasp trading concepts, terminology, and strategies.

2. Choose a Reliable Forex Broker

Your broker acts as the intermediary for your trades. Select a reputable broker that is regulated and offers a user-friendly trading platform. Look for brokers that provide low spreads, good customer service, and a variety of trading tools.

3. Create a Trading Plan

A well-defined trading plan is crucial for your success. This plan should detail your trading goals, risk tolerance, and the strategies you plan to use. A robust plan will help you stay disciplined during trading sessions.

4. Start with a Demo Account

Most reputable Forex brokers offer demo accounts. Use a demo account to practice trading without risking real money. This allows you to familiarize yourself with the platform and test your strategies in a risk-free environment.

Key Trading Concepts

Leverage and Margin

One unique feature of Forex trading is the ability to use leverage, allowing you to trade larger positions than your initial investment. While leverage can amplify profits, it also increases the risk of losses. Understand the concept of margin, as it is the amount of capital required to open a leveraged position. Always trade with caution.

Technical vs. Fundamental Analysis

Forex traders primarily use two forms of analysis to inform their trading decisions:

- Technical Analysis: This involves analyzing historical price data and using charts to make predictions about future price movements. Technical indicators, such as moving averages and RSI, are often used to identify trends.

- Fundamental Analysis: This approach focuses on economic indicators, reports, and news events to evaluate the potential impact on currency values. Factors such as interest rates, employment data, and geopolitical developments can significantly influence currency markets.

Common Mistakes to Avoid

As a beginner trader, it’s vital to be aware of common pitfalls that can hinder your progress. Here are a few mistakes to avoid:

1. Over-leveraging

While leverage can lead to substantial profits, over-leveraging can also result in significant losses. Maintain a balanced approach and avoid risking more than you can afford to lose.

2. Lack of Discipline

Emotions can cloud your judgment in trading. Stick to your trading plan and avoid making impulsive decisions based on market fluctuations or personal emotions.

3. Ignoring Risk Management

Effective risk management is pivotal in Forex trading. Use stop-loss orders to limit potential losses and never risk more than a small percentage of your trading capital on a single trade.

Practicing Good Trading Habits

To succeed in Forex trading, it’s essential to develop consistent trading habits. Here are some tips to cultivate:

- Review your trades regularly to learn from both wins and losses.

- Stay informed about global economic events and news, as they can have immediate effects on currency values.

- Be patient and allow your trading plan to unfold, rather than chasing quick profits.

- Keep a trading journal to document your strategies, insights, and emotions during trading.

Conclusion

Forex trading can be a lucrative venture for those who approach it with the right mindset and knowledge. As a beginner, take the time to educate yourself on the market dynamics and trading strategies. By sticking to your trading plan, practicing sound risk management, and continually refining your skills, you’ll be on your way to becoming a successful Forex trader.