When a loved one dies, households often worry about costs months or perhaps years resolving probate proceedings. The idea of lawful charges, court looks, and documentation can really feel difficult throughout a currently hard time. Nonetheless, The golden state regulation supplies less complex options for even more modest estates that reduce both time and cost.

The small estate affidavit technique uses a useful choice to complete probate administration, and a streamlined probate procedure can be a lot more cost-effective in certain conditions. San Diego probate attorney Mark Ignacio aids households recognize when these changed treatments use and how to utilize them effectively. Instead of facing lengthy court procedures, qualified families can commonly transfer possessions and resolve affairs within weeks rather than months.

What Certifies as a Small Estate in California

California law specifies Small estates based upon specific buck limits, which are adjusted every three years for inflation.там Nevada Affidavit of Small Estate Из нашей статьи According to the 2025 The Golden State Courts Self-Help Guide:

- For deaths before April 1, 2022: $166,250

- For deaths in between April 1, 2022, and March 31, 2025: $184,500

- For deaths on or after April 1, 2025: $208,850

These limits put on the gross worth of the decedent’s estate, omitting certain assets such as:

- Properties kept in joint tenancy

- Assets with designated recipients (e.g., life insurance policy, retirement accounts)

- Possessions held in a living trust fund

- Real property beyond The golden state

Exactly How the Small Estate Sworn Statement Refine Functions

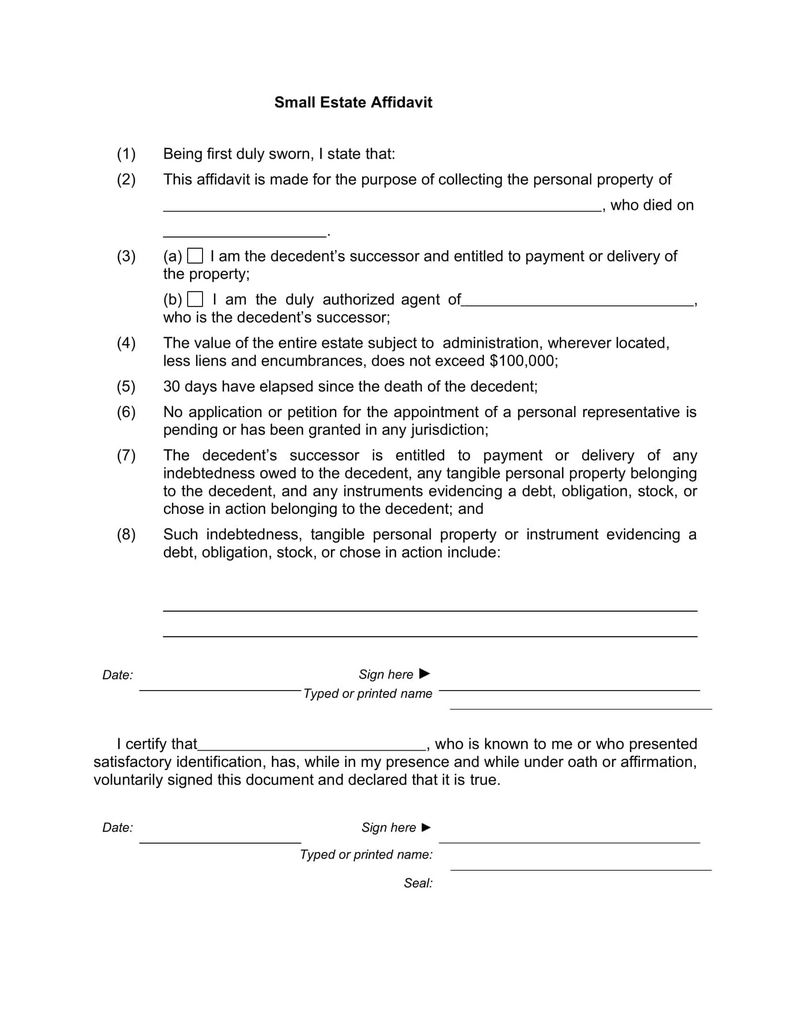

The Small estate sworn statement supplies a structured technique for transferring possessions, using a practical example of exactly how to avoid expensive probate disputes. The golden state courts need waiting a minimum of 40 days after an individual’s fatality before starting asset transfers. This waiting duration helps protect creditors’ civil liberties and prevents rushed choices throughout the first mourning period, further minimizing the capacity for lawful conflict.

Eligible successors can prepare and authorize sworn affidavits mentioning their right to obtain details possessions. These affidavits must consist of comprehensive info about:

- The dead person’s information. This consists of full name, date of fatality, and last well-known address to appropriately identify the estate.

- Property summaries. Synopsis specific details concerning each possession being declared, including account numbers and approximated values.

- Lawful privilege. Offer a clear description of why the person authorizing the affidavit has the right to get the possessions.

- Estate worth declaration. This is a promised declaration that the overall estate worth falls listed below the certifying limit.

Currently, it is very important to bear in mind that banks, investment companies, and various other banks review these sworn statements in addition to sustaining documents such as fatality certifications and recognition. Many organizations have developed treatments for Small estate transfers, though processing times and needs vary.

The The Golden State Department of Motor Cars adheres to comparable sworn statement procedures for lorry transfers but has its very own forms and needs. Personal effects transfers usually take place informally among family members, however beneficial things may need paperwork for insurance policy or tax objectives.

When Streamlined Probate Makes Good Sense

Also holdings that go beyond Small estate limits may get approved for California’s streamlined probate treatments in certain conditions. These treatments, while still requiring court involvement, reduce many traditional probate needs.

Determining between Small estate affidavits and streamlined probate usually relies on possession intricacy as opposed to simply complete value. San Diego probate lawyer Mark Ignacio might suggest simplified probate when:

- Several asset types exist. Estates with numerous checking account, financial investment accounts, and company interests may benefit from court supervision.

- Family disagreements arise. When beneficiaries differ regarding property circulation, court oversight offers legal defense.

- Lender concerns exist. If possible financial institution insurance claims need resolution, official procedures use better defense.

- Real estate problems happen. Quality in multiple states or with vague titles may require court involvement.

Some assets need court participation regardless of estate dimension. As an example, if the dead had realty in numerous states or had pending claim claims, official probate process might be required also for otherwise Small estates.

Why San Diego Estate Preparation With Mark Ignacio Regulation Still Matters for Small Estates

Many people assume that moderate holdings planned for recipient distribution do not need advance preparation given that simplified treatments are offered. Nonetheless, appropriate estate planning can make Small estate administration much easier for enduring family members.

An effectively drafted will certainly clarifies your regulations – also those that include your charitable and faiths – and gives legal authority for asset distribution. Without a will, California’s intestacy laws identify who inherits what, which might not match your actual wishes.

Trust-based estate plans help families prevent probate totally, no matter estate dimension. Revocable living depends on permit property transfers without court participation or waiting periods. For San Diego households managing important property, counts on provide certain advantages since California property worths commonly push estates over Small estate thresholds.