In the fast-paced world of financial markets, the ability to trade on the go has transformed how traders operate. Mobile forex trading has become a game-changer, allowing traders to execute trades, monitor the market, and access crucial information from anywhere at any time. This article explores the dynamics of mobile forex trading, offering insights into strategies, advantages, and tips for maximizing your success. For more resources and tools, visit mobile forex trading trading-uganda.com.

1. Introduction to Mobile Forex Trading

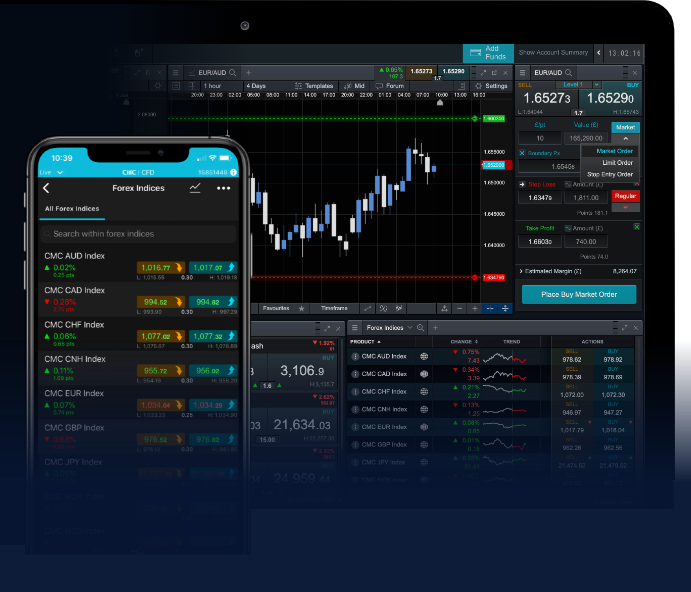

Mobile forex trading refers to the process of buying and selling currencies through mobile devices such as smartphones and tablets. Mobile trading apps provide traders with instant access to their trading accounts, enabling them to make informed decisions on the fly. The convenience of mobile trading has led to its rapid adoption among both novice and experienced traders.

2. Advantages of Mobile Forex Trading

The rise of mobile forex trading has been driven by numerous advantages that appeal to a wide range of traders. Here are some of the key benefits:

2.1. Accessibility

Mobile forex trading allows traders to engage with the market from virtually anywhere. Whether you are commuting, traveling, or enjoying some leisure time, as long as you have an internet connection, you can manage your trading activities.

2.2. Real-Time Monitoring

With mobile trading apps, traders can monitor market movements in real time. This immediate access to financial news and price changes allows traders to respond quickly to market fluctuations, which is critical in the highly volatile forex market.

2.3. Enhanced Trading Tools

Most mobile trading apps come equipped with advanced trading tools, including charting features, technical analysis, and news feeds. These tools help traders make informed decisions and refine their trading strategies while on the go.

2.4. User-Friendly Interface

Mobile trading applications are designed with user experience in mind. The intuitive interfaces make it easy for traders of all experience levels to navigate the app, execute trades, and access essential features without a steep learning curve.

3. Choosing the Right Mobile Trading Platform

Selecting a reliable mobile trading platform is crucial to your trading success. Here are some factors to consider when choosing a mobile forex trading app:

3.1. Security

Ensure that the mobile trading platform employs strong security measures to protect your personal information and trading activities. Look for features such as two-factor authentication and encryption.

3.2. Range of Currency Pairs

Choose a platform that provides a wide array of currency pairs to trade. A diverse selection allows you to explore various trading opportunities and manage risks effectively.

3.3. User Reviews and Support

If you are considering a specific mobile trading app, read user reviews and check for customer support options. Reliable support can be crucial, especially when you encounter issues while trading.

4. Strategies for Successful Mobile Forex Trading

To thrive in mobile forex trading, it’s essential to adopt sound strategies that align with your trading goals. Here are some effective strategies to enhance your trading performance:

4.1. Set Clear Goals

Before engaging in mobile trading, define your trading goals. Are you looking for short-term profit, or are you interested in long-term investments? Having clear objectives will guide your trading decisions and help you stay focused.

4.2. Utilize Stop-Loss Orders

Implementing stop-loss orders is a crucial risk management strategy in forex trading. By setting stop-loss limits, you can protect your capital from significant losses, allowing for more stable trading outcomes.

4.3. Stay Informed

Regularly check financial news and economic indicators that affect currency prices. Furthermore, make use of analysis tools available on your trading app to gain insights into market trends and patterns.

4.4. Practice with a Demo Account

If you’re new to mobile forex trading, consider using a demo account before risking real money. Most trading platforms offer demo accounts that allow you to practice trading strategies without financial risk.

5. Common Mistakes to Avoid

While mobile forex trading offers numerous advantages, many traders fall into common pitfalls. Here are some mistakes to avoid:

5.1. Overtrading

The convenience of mobile trading can lead to overtrading, where traders make excessive trades based on impulse rather than careful analysis. Develop a disciplined trading plan to avoid this common mistake.

5.2. Ignoring Emotions

Emotion-driven trading can result in poor decisions. Stay composed, and avoid trading based on fear or greed. Maintain a clear mindset and follow your trading strategy.

5.3. Lack of a Risk Management Plan

Failing to implement a proper risk management plan can lead to significant losses. Always determine how much of your capital you are willing to risk on each trade and stick to that limit.

6. Conclusion

Mobile forex trading has revolutionized the way traders engage with the foreign exchange market. With the right strategies and tools, anyone can become a successful mobile trader. As you embark on your trading journey, remember to choose a reliable trading platform, define your goals, manage risks, and continuously educate yourself about the markets. Embrace the flexibility that mobile trading offers, and take your forex trading experience to new heights.

In summary, mobile forex trading is not just about convenience; it’s about making smart, informed decisions that can lead to success in the dynamic world of currency trading. Happy trading!