Forex trading has become increasingly accessible to individuals around the globe, especially with the advent of low minimum deposit options. Platforms like forex trading low minimum deposit Web Global Trading have revolutionized how new traders enter the market, providing the opportunity to start trading currencies without having to commit substantial capital. In this article, we’ll explore the concept of forex trading with low minimum deposits, its advantages, potential drawbacks, and tips for beginners looking to make their mark in the forex market.

Understanding Forex Trading

The foreign exchange market, commonly known as forex, is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, the forex market operates 24 hours a day, five days a week, enabling traders to engage from virtually anywhere in the world. This market allows the exchange of currencies, aiming for profit through fluctuations in currency prices.

The Impact of Low Minimum Deposits

One of the most significant shifts in the forex landscape is the introduction of brokers that offer low minimum deposit accounts. Traditionally, many brokers required a hefty initial deposit, which could be a barrier for novice traders. However, the emergence of brokers allowing deposits as low as $10 or even less has opened the door for many aspiring traders.

Benefits of Low Minimum Deposit Trading

- Accessibility: Individuals who may not have thousands of dollars to invest can participate in forex trading, making it accessible to a broader audience.

- Lower Risk: By starting with a small investment, traders can limit their financial exposure as they learn the ropes of trading.

- Flexibility: Low minimum deposits allow traders to practice various strategies without financial pressure, promoting a more experimental approach to trading.

- Opportunity for Learning: New traders can gain hands-on experience with real funds without the fear of significant losses, enabling them to learn from their mistakes.

Choosing the Right Broker

When considering forex trading with a low minimum deposit, selecting a suitable broker is crucial. Here are critical factors to consider:

- Regulation: Ensure the broker is regulated by a reputable authority, which adds a layer of security and trust.

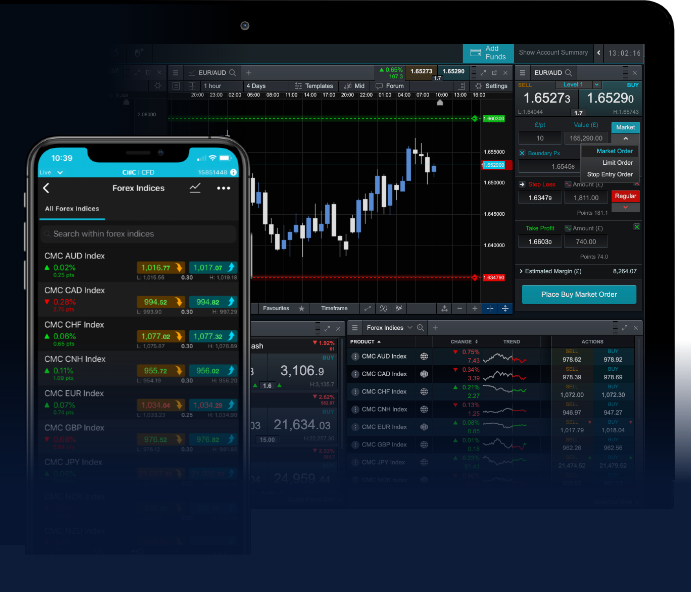

- Trading Platform: A user-friendly trading platform can significantly enhance your trading experience.

- Support and Resources: Choose a broker that provides educational resources, customer support, and trading tools that can aid your learning process.

- Fees and Spreads: Pay attention to the trading fees and spreads that the broker charges, as these can affect your overall profitability.

Common Mistakes to Avoid

While trading with a low minimum deposit can be advantageous, new traders must be aware of common pitfalls that can lead to frustration and losses:

- Overleveraging: While leverage can amplify profits, it also magnifies losses. It’s crucial to use leverage wisely and understand the risks involved.

- Trading Emotionally: Making decisions based on emotions, such as fear or greed, can lead to poor trading choices. Developing a solid trading plan and sticking to it is essential.

- Neglecting Education: Many new traders might jump in without adequate knowledge. Investing time in learning about trading strategies, market analysis, and risk management is vital for long-term success.

Developing a Trading Strategy

A well-defined trading strategy is fundamental for success in forex trading. Here are some popular strategies suitable for traders starting with a low minimum deposit:

- Scalping: This strategy focuses on making small profits from tiny price changes, requiring quick decision-making and constant monitoring of the market.

- Day Trading: Day traders buy and sell currencies within the same day, avoiding overnight risk while aiming for daily profit.

- Swing Trading: Swing traders hold positions for several days or weeks, focusing on capturing short- to medium-term market moves.

Risk Management Techniques

No trading strategy is complete without an effective risk management plan. Here are essential techniques to protect your investment:

- Set Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses by automatically closing a position at a predetermined price.

- Position Sizing: Establish how much capital to risk on each trade to ensure that no single trade can significantly affect your overall capital.

- Diversification: Avoid putting all your capital in one trade or currency pair. Diversifying can help mitigate risks associated with individual trades.

Conclusion

Forex trading with low minimum deposits presents a unique opportunity for beginners and experienced traders alike. By understanding the advantages, choosing the right broker, avoiding common mistakes, and implementing effective strategies and risk management techniques, you can embark on a successful trading journey. As you gain experience and confidence, you may choose to increase your investment, but starting small can ensure that you develop the necessary skills without risking significant capital. Embrace the world of forex trading and make informed decisions to potentially enhance your financial future.

Happy trading!