Mastering the Exness Scalping Strategy

Scalping is a popular trading strategy among forex traders that focuses on making small, quick profits. In this article, we will delve into the Exness Scalping Strategy https://exnesscom.net/, explaining its principles and providing insights on how to effectively implement it in your trading routine.

What is Scalping?

Scalping involves executing a high volume of trades over short periods. Traders who employ this strategy, known as scalpers, seek to capitalize on small price movements. They typically hold positions for only a few seconds to several minutes, aiming for quick returns. Scalping can be particularly effective in highly liquid markets where price fluctuations are frequent.

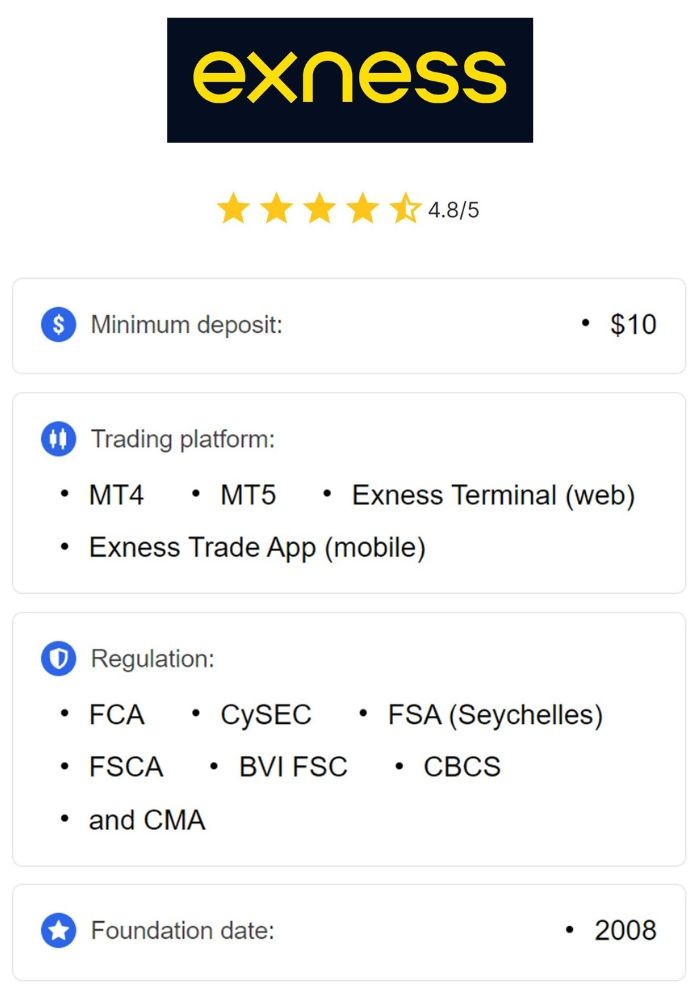

Why Choose Exness for Scalping?

Exness is known for its excellent trading conditions, making it an attractive platform for scalpers. Key features include:

- Low Spreads: Tight spreads allow traders to maximize their profits on small moves.

- High Leverage: Exness offers high leverage, enabling traders to control larger positions with less capital.

- Fast Execution: Rapid order execution is crucial for scalpers to minimize slippage and capitalize on price movements.

Key Components of the Exness Scalping Strategy

To effectively implement the Exness Scalping Strategy, you should focus on several key components:

1. Choose the Right Currency Pairs

Selecting the right currency pairs is essential for scalping. Focus on major pairs such as EUR/USD, GBP/USD, and USD/JPY, as they tend to be more liquid and have narrower spreads. Volatility can also play a significant role, so observe which pairs experience consistent price movements.

2. Utilize Technical Analysis

Technical analysis is vital for scalping. Indicator tools such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands can help you identify entry and exit points effectively. For instance, you can look for crossovers in moving averages to signal potential buy or sell opportunities.

3. Time Frames

For scalping, shorter time frames are the most effective. Consider using 1-minute or 5-minute charts to analyze price movements. By utilizing shorter time frames, you can identify trends and reversals quickly, allowing you to enter and exit positions effectively.

4. Risk Management

Implementing strong risk management practices is essential in a scalping strategy. Set stop-loss orders to protect your capital and ensure that potential losses are minimized. A common rule is to risk only a small percentage of your trading capital on each trade, typically no more than 1-2%.

5. Stay Informed

Market news and economic announcements can significantly impact currency prices. Staying updated with financial news can help you anticipate market movements. Be cautious of trading during high-impact news releases, as volatility can lead to unexpected price swings.

Practice Makes Perfect

Before diving into live trading with the Exness Scalping Strategy, consider practicing on a demo account. This allows you to familiarize yourself with the platform, test your strategy, and make adjustments without risking real money. Use the demo account to experiment with different technical indicators and assess how changing market conditions affect your trades.

Final Thoughts

Scalping can be a rewarding strategy for those who commit time, discipline, and practice. The Exness Scalping Strategy provides an excellent framework for traders looking to capitalize on small price movements with effective risk management practices. Always remember, while the potential for profit exists, the risk of loss is also significant. Continuous education and practice are key to mastering scalping.

In conclusion, the Exness Scalping Strategy is about precision, quick decision-making, and using the right tools at your disposal. Use this guide to develop a solid trading strategy that aligns with your trading goals, and soon you may find yourself on the path to successful trading as a scalper.