How to Make Safe Deposits: A Comprehensive Guide

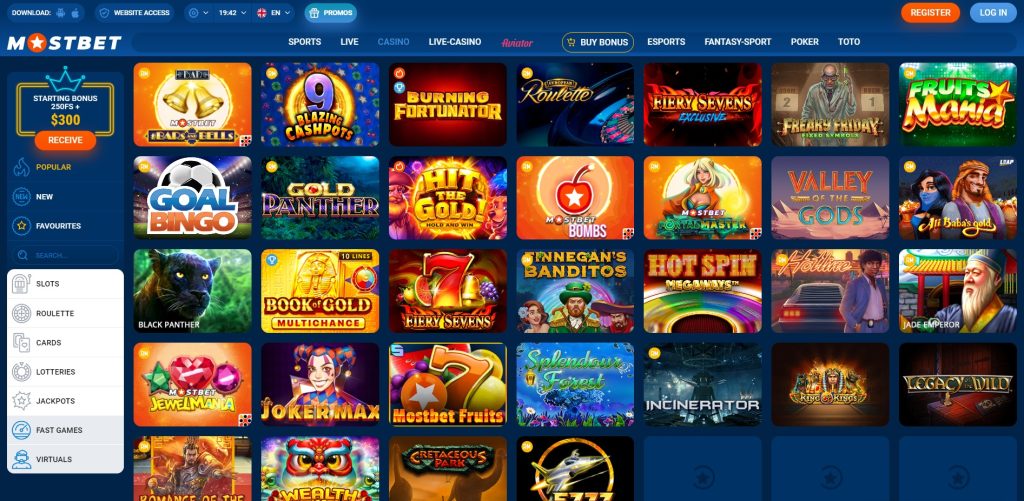

When it comes to managing finances, one of the most critical aspects is ensuring safe deposits. Whether you are moving money to a bank account, making an online transaction, or investing, understanding how to secure your deposits is essential.How to Make Safe Deposits and Withdrawals at Sportsbooks in Bangladesh Mostbet online Below, we will explore various strategies and best practices to help you make safe deposits.

1. Understanding the Importance of Safe Deposits

Safe deposits are crucial for protecting your money from theft, fraud, and loss. With the rise of digital banking and online transactions, the risk of encountering scams and cyber threats has increased. Understanding the nature of these risks will help you take preventative measures to protect your finances.

2. Choosing the Right Financial Institution

The first step to making safe deposits is ensuring that you choose a reputable financial institution. Conduct thorough research on banks, credit unions, and online payment platforms. Look for institutions that offer:

- Insurance coverage (like FDIC insurance) on deposits.

- A transparent record of customer service and complaint resolution.

3. Best Practices for Online Transactions

In today’s digital age, online transactions are commonplace. However, they also come with increased risks. Here are some best practices for making safe online deposits:

- Use Secure Networks: Avoid making deposits when connected to public Wi-Fi networks. Instead, use a secure private network or a VPN.

- Enable Two-Factor Authentication (2FA): Secure your accounts by enabling 2FA, which adds an additional layer of protection.

- Monitor Your Accounts Regularly: Regularly review your bank statements to spot any unauthorized transactions quickly.

4. Checking for Secure Payment Methods

When making deposits, especially online, make sure to use secure payment methods. Credit cards, PayPal, and other digital wallets often provide buyer protection. Avoid using less secure methods such as wire transfers for unknown entities, which might leave you with no recourse if something goes wrong.

5. Physical Deposits: Cash and Checks

For those who prefer physical deposits, such as cash or checks, several safety measures can be taken:

- Deposit During Business Hours: Conduct transactions during bank hours to ensure security.

- Use Deposit ATMs: Utilize bank-affiliated ATMs for deposits instead of standalone machines.

- Take Precautions Against Theft: When carrying cash, be aware of your surroundings and avoid displaying large amounts of money.

6. Educating Yourself About Scams

Email phishing and other scams are common tactics used by criminals to steal personal information. Educate yourself on how to recognize suspicious emails, phone calls, or texts asking for sensitive information. Always verify the source before sharing any personal details.

7. Keeping Personal Information Private

Protecting your personal information is vital for safe deposits. Here are some tips:

- Shred Sensitive Documents: Shred any documents that contain personal information before disposing of them.

- Limit Social Media Sharing: Avoid oversharing personal information on social media platforms.

- Use Strong Passwords: Create complex passwords for your online banking and financial accounts.

8. Regularly Update Technology

Make sure to regularly update your devices, software, and applications to protect against security vulnerabilities. Enabled automatic updates wherever possible, especially for your operating system and antivirus software.

9. Consulting Financial Advisors

If you’re unsure about the best practices for making safe deposits or managing your finances effectively, consider consulting with a financial advisor. They can provide personalized guidance based on your unique financial situation.

10. Keeping Records of Transactions

Maintain detailed records of every transaction you make. This practice not only helps in tracking your finances but also serves as evidence in case you need to dispute a transaction.

Conclusion

Making safe deposits is a multifaceted endeavor that requires awareness, vigilance, and proactive measures. By educating yourself and implementing the steps outlined in this guide, you can significantly reduce the risks associated with financial transactions. Remember, your security starts with informed decision-making and the proactive management of your financial assets.