The forex (foreign exchange) market is one of the largest and most liquid financial markets in the world, with a daily trading volume exceeding $6 trillion. With such immense potential for profit, it’s no wonder that many individuals and institutions turn to forex trading companies for their trading needs. This article will delve into the role of forex trading companies, their importance in the trading ecosystem, and how you can select the right one for your unique requirements. Moreover, we will examine how platforms like forex trading company forex-vietnam.net are shaping the landscape of forex trading.

What is a Forex Trading Company?

A forex trading company serves as an intermediary between individual traders (retail traders) and the forex market. These companies provide trading platforms that enable individuals to buy and sell currencies. Forex trading companies can range from large multinational firms to smaller, local brokers, each offering different types of services, account types, and trading conditions.

The Role of Forex Trading Companies

Forex trading companies are pivotal in ensuring the smooth operation of the forex market. They provide essential services such as:

- Market Access: They offer access to the global forex markets, enabling traders to execute buy and sell orders on various currency pairs.

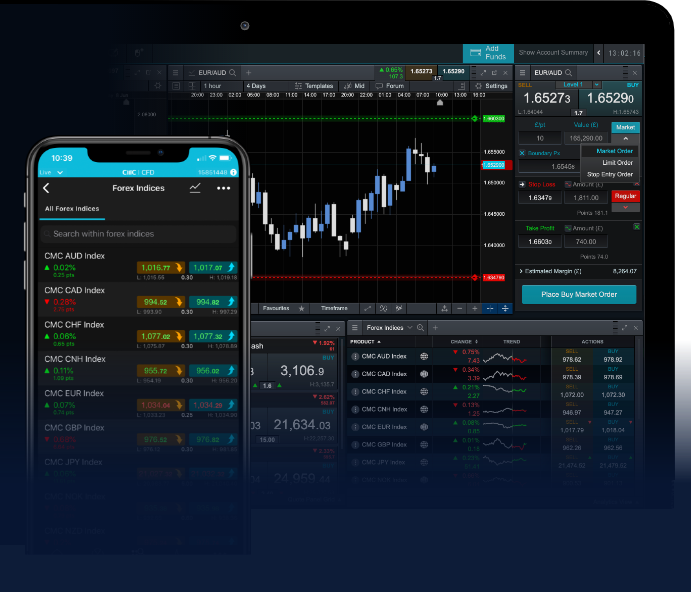

- Trading Platforms: Most forex trading companies provide proprietary or third-party trading platforms that facilitate easy execution of trades, real-time data analysis, and charting tools.

- Leverage and Margin Trading: Forex brokers allow traders to use leverage, which means they can trade larger positions with a smaller amount of capital, thus amplifying potential gains (and losses).

- Educational Resources: Many brokers offer training programs, webinars, and trading resources to help both new and experienced traders enhance their trading skills.

Choosing the Right Forex Trading Company

Selecting the right forex trading company can have a significant impact on your trading experience. Here are some key factors to consider:

1. Regulation and Licensing

It is crucial to ensure that the forex trading company you choose is regulated by a reputable financial authority. Regulations are designed to protect traders and ensure that brokers adhere to strict financial standards. Regulatory bodies such as the Commodity Futures Trading Commission (CFTC) in the USA, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC) are examples of respected regulators.

2. Trading Costs

Trading costs can vary widely among forex trading companies. Look for brokers that offer competitive spreads and low commission fees. It is advisable to compare these costs, as they can significantly affect your profitability, especially if you are an active trader.

3. Trading Platforms and Tools

The trading platform provided by the forex trading company is a critical aspect of the trading experience. Check for user-friendly interfaces, the availability of technical analysis tools, and customizable features. Some traders prefer platforms like MetaTrader 4 or MetaTrader 5 for their extensive capabilities.

4. Customer Support

Quality customer support is essential. Ensure that the forex trading company offers multiple communication channels, including email, live chat, and phone support, and check for available support hours.

5. Range of Currency Pairs

Depending on your trading strategy, you may want to trade specific currency pairs. Make sure that the broker offers a broad selection, including major, minor, and exotic pairs.

6. Educational Resources

If you’re new to forex trading, educational resources offered by the trading company can be immensely beneficial. Look for brokers that provide tutorials, webinars, and trading courses aimed at different experience levels.

The Future of Forex Trading Companies

The forex trading landscape is continuously evolving, influenced by advancements in technology, regulatory changes, and market dynamics. Many forex trading companies are adopting innovative technologies such as artificial intelligence and machine learning to enhance trading experiences. These technologies can provide traders with predictive insights and personalized recommendations, making it easier to identify profitable opportunities.

Additionally, the rise of mobile trading applications has transformed how traders engage with the forex market. Nowadays, traders can monitor their accounts and execute trades directly from their smartphones, offering unprecedented access and flexibility.

Conclusion

Forex trading companies play an essential role in the functioning of the forex market, providing traders with the necessary tools and resources to succeed. By understanding what to look for when choosing a broker, you can enhance your trading experience and increase your chances of profitability. As the market continues to evolve, platforms such as forex-vietnam.net are leading the way in offering traders innovative solutions and valuable resources. Whether you are a novice or an experienced trader, the right forex trading company can help you navigate the complexities of the forex market more effectively.