Pocket Option vs Olymp Trade: A Comprehensive Comparison

When it comes to online trading platforms, two names that frequently emerge in discussions are pocket option vs olymp trade Pocket Option and Olymp Trade. Both platforms have garnered considerable attention among traders around the globe for their unique features and trading opportunities. This article aims to provide an in-depth comparison between Pocket Option and Olymp Trade, covering various aspects such as user interface, trading instruments, account types, customer support, and more. By the end, readers will have a clearer understanding of which platform may best serve their trading needs.

User Interface and Experience

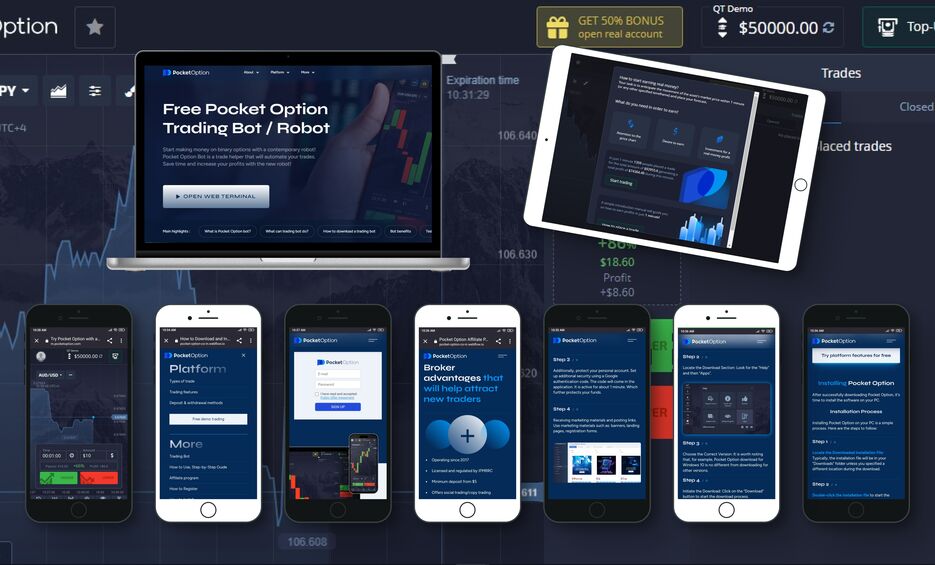

The user interface of a trading platform plays a crucial role in determining how effectively individuals can navigate and execute trades. Pocket Option boasts a user-friendly design that’s appealing to both novice and experienced traders. The layout is straightforward, allowing users to access various trading tools and analytics without any frills. On the other hand, Olymp Trade also presents a clean interface but emphasizes educational materials and trading strategies. Users can easily switch between different asset classes and analyze their charts with sophisticated tools.

Account Types

Both Pocket Option and Olymp Trade offer different types of accounts suited to various trading preferences and experience levels. Pocket Option provides a demo account, which is fundamental for beginners to practice trading without risking real funds. Additionally, they have various live account types, allowing for flexible deposit amounts and corresponding benefits. On the contrary, Olymp Trade also offers a demo account, alongside a standard account that enables traders to access different resources and trading perks. However, it’s essential to analyze the minimum deposit requirements of each platform before making a decision.

Trading Instruments

The range of trading instruments available can significantly influence a trader’s strategy. Pocket Option has a diverse selection of assets, including forex, commodities, stocks, and cryptocurrency options. This variety allows traders to diversify their portfolios effectively. Olymp Trade, while slightly more limited in its asset offerings, primarily focuses on forex and cryptocurrency. This makes it an ideal platform for users looking to specialize in these particular markets.

Leverage and Profit Potential

Leverage is a powerful tool that can amplify potential profits but also comes with increased risks. Pocket Option offers leverage up to 1:500, which is higher than many competitors. This allows traders to control larger positions with smaller capital outlays. Olymp Trade, however, typically offers leverage up to 1:200. As a trader, understanding the risks associated with high leverage is vital, and it’s a good idea to assess personal risk tolerance when choosing a platform.

Trading Features

One of the standout features of Pocket Option is its social trading functionality, which allows users to follow and copy the trades of experienced traders. This can be a valuable learning tool for newcomers. Additionally, Pocket Option provides a range of indicators, charts, and analysis tools essential for executing successful trades.

Olymp Trade also comes with an array of features, including trading signals and an extensive knowledge base filled with educational articles and videos. Their platform supports a range of charting tools essential for technical analysis. Moreover, Olymp Trade provides a unique feature called the ‘Portfolio,’ where users can view their past trades and analyze their performance — a useful resource for continuous improvement.

Customer Support

In the world of online trading, having access to reliable customer support is paramount. Pocket Option offers 24/7 customer assistance through live chat and email, responding promptly to user inquiries. The platform also has a comprehensive FAQ section to help users find answers more quickly.

Olymp Trade, meanwhile, boasts a robust customer support system that includes a live chat feature, email support, and a dedicated help section. They offer support in multiple languages, catering to a global audience. Both platforms demonstrate a commitment to helping their users navigate any challenges they may encounter while trading.

Regulation and Safety

Regulation is a critical factor when considering the safety of a trading platform. Pocket Option operates under a license obtained in the Seychelles, which makes it less regulated compared to some other platforms. This regulatory environment may raise concerns for traders who prioritize strict oversight. Conversely, Olymp Trade is regulated by the International Financial Commission (IFC), which provides an additional layer of security for its traders. Understanding the implications of these regulations can guide users in their choice of platform.

Deposit and Withdrawal Methods

The ease of funding accounts and withdrawing profits is vital for any trader. Pocket Option supports a variety of payment methods, including credit/debit cards, e-wallets, and cryptocurrencies, allowing for flexible funding options. Withdrawals are generally processed within 24 hours, which is an attractive feature for active traders.

Similarly, Olymp Trade also offers multiple deposit and withdrawal methods. Users can fund their accounts via bank cards, e-wallets, and local payment systems. However, while deposits may be instant, withdrawals can take longer due to the verification process, sometimes extending up to a few days. Both platforms have set minimum withdrawal limits that users should be aware of before engaging in trading.

Conclusion

In summary, both Pocket Option and Olymp Trade present commendable options for traders looking to engage in online trading. Pocket Option shines in its social trading features and high leverage, making it suitable for those who prefer a more interactive approach to trading. Meanwhile, Olymp Trade excels with its educational resources and regulatory robustness, aiming to foster a strong foundation for novice traders. Ultimately, the best choice between these two platforms will depend on individual trading preferences and goals. Potential users are encouraged to carefully assess each platform’s features and align them with their own trading needs.