Are all cryptocurrencies the same

While there are thousands of cryptocurrencies out there, ranging from the big hitters (Bitcoin) to the ridiculous (Dogecoin, also known as the first meme coin), cryptocurrencies can be grouped into four basic categories:

Another way to determine monetary value is to tie a cryptocurrency to another known asset https://xerometer.com. Cryptocurrencies that fall under this category are known and stablecoins. The U.S. Dollar Coin (USDC) is a good example. Its value is pegged directly to the value of the U.S. dollar. One USDC equals one U.S. dollar.

Finally, cryptocurrencies differ greatly in terms of their general acceptance. Once again, Bitcoin is the standard. It is the most widely accepted cryptocurrency around the world. If you run across any online or brick-and-mortar merchant willing to accept cryptocurrency, it is likely that merchant accepts Bitcoin – even if other cryptos are accepted alongside it.

Digital currencies, however, extend the concept. For example, a gaming network token can extend the life of a player or provide them with extra superpowers. This is not a purchase or sale transaction but, instead, represents a transfer of value.

On the other hand, cryptocurrencies are free from any type of centralized control. It is also important to note that regulatory uncertainty regarding cryptocurrencies places users at risk. For example, you cannot approach any court for loss of crypto funds to a scam.

What is the market cap of all cryptocurrencies

However, not all cryptocurrencies work in the same way. While all cryptocurrencies leverage cryptographic methods to some extent (hence the name), we can now find a number of different cryptocurrency designs that all have their own strengths and weaknesses.

Bitcoin is the most popular cryptocurrency and enjoys the most adoption among both individuals and businesses. However, there are many different cryptocurrencies that all have their own advantages or disadvantages.

However, not all cryptocurrencies work in the same way. While all cryptocurrencies leverage cryptographic methods to some extent (hence the name), we can now find a number of different cryptocurrency designs that all have their own strengths and weaknesses.

Bitcoin is the most popular cryptocurrency and enjoys the most adoption among both individuals and businesses. However, there are many different cryptocurrencies that all have their own advantages or disadvantages.

However, it’s not always the case that big market moves are connected to specific events. Sometimes, the cryptocurrency market moves because of technical factors, such as important support and resistance price levels.

Cryptocurrency and blockchain technology has evolved significantly since Bitcoin was first released in 2009. Today, it’s helpful to categorize digital currencies in different sectors. Let’s explore the biggest cryptocurrencies in each major category:

Do all cryptocurrencies use blockchain

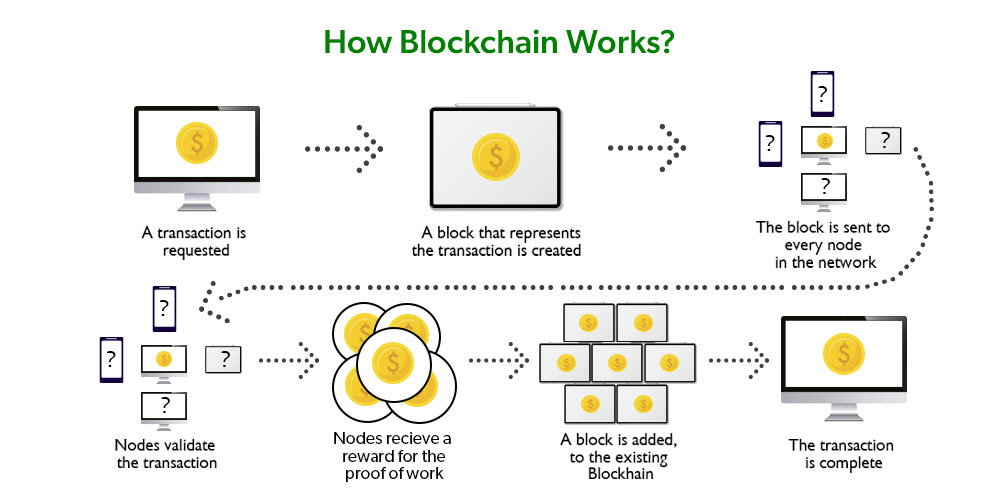

Once a block is closed, a transaction is complete. However, the block is not considered confirmed until five other blocks have been validated. Confirmation takes the network about one hour to complete because it averages just under 10 minutes per block (the first block with your transaction and five following blocks multiplied by 10 equals 60 minutes).

Perhaps no industry stands to benefit from integrating blockchain into its business operations more than personal banking. Financial institutions only operate during business hours, usually five days a week. That means if you try to deposit a check on Friday at 6 p.m., you will likely have to wait until Monday morning to see the money in your account.

The main pros of DAG networks have to do with mining. Because no mining takes place, there are no mining fees associated with making DAG transactions. Seeing how block rewards are falling, mining fees are bound to rise in order to incentivize miners to continue mining. In that respect, a system that would eliminate mining fees altogether looks promising for the future.

Once a block is closed, a transaction is complete. However, the block is not considered confirmed until five other blocks have been validated. Confirmation takes the network about one hour to complete because it averages just under 10 minutes per block (the first block with your transaction and five following blocks multiplied by 10 equals 60 minutes).

Perhaps no industry stands to benefit from integrating blockchain into its business operations more than personal banking. Financial institutions only operate during business hours, usually five days a week. That means if you try to deposit a check on Friday at 6 p.m., you will likely have to wait until Monday morning to see the money in your account.

The main pros of DAG networks have to do with mining. Because no mining takes place, there are no mining fees associated with making DAG transactions. Seeing how block rewards are falling, mining fees are bound to rise in order to incentivize miners to continue mining. In that respect, a system that would eliminate mining fees altogether looks promising for the future.