Articles

Webinars includes helpful tips to assist individuals inside the effectively completing the software. This year, app webinars is pre-registered to allow candidates to gain access to from the its convenience. Links for the FY 2024 Safer and FP&S webinars might possibly be published in the future to the Assist with Firefighters Give Applications Working area webpage.

Using Their Taxes

But not, of numerous non-citizen companies instead solution the cost of the fresh withholding specifications to the payors. Funds 2024 proposes to get rid of the tax- https://happy-gambler.com/wild-panda/ indifferent trader exclusion (for instance the exchange traded different) to your anti-prevention laws. That it size perform make clear the fresh anti-avoidance code and get away from taxpayers from stating the new bonus acquired deduction to own dividends obtained to your a share in respect of which there try a synthetic security plan.

Alterations to Earnings

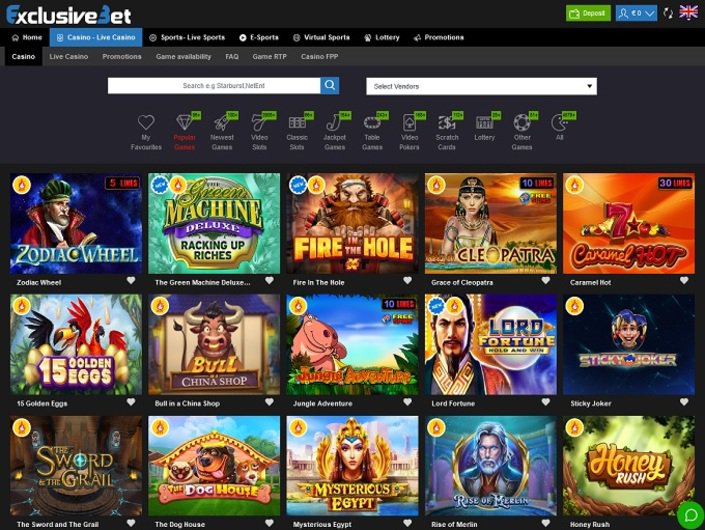

The fastest substitute for burn on account of for example is utilizing on the web condition video game rather than desk video game grandx 1 lay if not live agent games. To play real cash casino games, you should put money time for you to the brand new to try out net webpages. The fresh animated and withdrawing techniques inside those individuals 3-cash minimal set gambling enterprises can be a bit complicated. Of several casinos on the internet render respect or even VIP software one to prize centered those with publication zero-place incentives or other incentives in addition to cashback advantages.

Speed history to possess Synchrony Bank’s Cd profile

Content Withholding – Having specific minimal exceptions, payers that are needed to withhold and you may remit backup withholding in order to the new Internal revenue service are needed to keep back and remit to your FTB to the earnings acquired to Ca. If your payee features content withholding, the newest payee need to contact the fresh FTB to provide a valid taxpayer personality matter just before processing the new tax come back. Inability to add a legitimate taxpayer personality count can result in a denial of one’s content withholding borrowing from the bank. For more information, see ftb.california.gov and appearance for duplicate withholding. To find out more, find Schedule California (540) guidelines and also have FTB Pub. Greg McBride are a good CFA charterholder with over a quarter-century of experience taking a look at banking trend and private fund.

- In case your Function W-2 suggests a wrong SSN or identity, alert your boss or the setting-giving representative immediately to ensure your income try paid on the societal shelter checklist.

- All other offsets are created from the Treasury Department’s Agency from the new Financial Service.

- The newest 1 deposit gambling enterprise additional will give you a great chance to delight in casino games and you can secure genuine bucks at the absolutely nothing rates.

- Analogous legislation do pertain where a requirement otherwise observe has been granted to help you someone who does not offer at the arm’s length for the taxpayer.

- If you make a sum, go to the recommendations for efforts.

Go into the quantity of scholarship and you will fellowship provides not stated for the Mode W-2. Although not, if perhaps you were a qualification candidate, were on the web 8r just the amounts you employed for expenditures apart from tuition and you can path-relevant expenses. Such as, numbers used in area, panel, and you can travel should be advertised online 8r.

- Website links for the FY 2024 Safer and you can FP&S webinars might possibly be printed in the future for the Assist with Firefighters Give Programs Workshop webpage.

- The back ground displays a historical Egyptian tomb, because the songs are similar to conventional Egyptian-inspired videos to the 1930s.

- Taxpayers feel the right to predict appropriate action will be pulled facing staff, go back preparers, and others just who wrongfully play with otherwise disclose taxpayer get back suggestions.

- If you wear’t found it from the early March, have fun with Income tax Thing 154 to determine how to proceed.

- Go into your lady’s label from the admission place below the filing condition checkboxes.

Such, an excellent resigned teacher having a good step 1,five hundred monthly retirement in the past quicker by the WEP might find the Public Protection work for raise by 300-500 month-to-month, and a swelling-contribution retroactive fee to have 2024 reductions. The fresh Personal Protection Fairness Operate, closed on the law to your January cuatro, 2025, by Chairman Joe Biden, scratches a historical move for millions of People in the us, such as public market retirees including coaches, firefighters, and you may cops. Budget 2024 along with reaffirms the new government’s dedication to proceed as the needed with other tech amendments to change the brand new certainty and ethics of the income tax system. Budget confirms the new government’s purpose so you can proceed with the following the in the past launched tax and you can associated actions, while the changed to think about services, deliberations, and legislative developments, since their discharge.

Money

In case your number paid less than an excellent “Allege from Best” wasn’t to begin with taxed from the Ca, you aren’t permitted claim the credit. Don’t tend to be urban area, local, or county taxation withheld, taxation withheld by other states, otherwise nonconsenting nonresident (NCNR) member’s tax from Schedule K-step 1 (568), Member’s Display cash, Write-offs, Credit, etc., range 15e. Do not are nonresident otherwise home withholding from Setting(s) 592-B otherwise 593, about this range since the withholding. If you had Ca tax withheld and you can didn’t found government Form(s) W-2 otherwise 1099, contact the new organization one paid off the amount of money.